The speculative orientation of profit-seeking pension funds towards hedge funds, the real estate sector and financial assets resulted in millions of people losing their retirement savings and getting bereft of their futures after the 2008 crisis. However, insurance need not be a speculative field and it can act as a means to design the future collectively. Arç Insurance Cooperative of Catalonia has been fighting for this cause since 1983. One of its partners, Alfonso B. Blado, tell their story.

How was Arç Insurance Cooperative born? What were the social and political circumstances in the country when you started?

Alfonso B. Bolado: Arç was founded in Barcelona, in 1983, right after the period called “transition to democracy” in Spain. During this period, we began reproducing and implementing those projects and ideas that we did not dare to dream about during the Franco dictatorship. Cooperativism, especially the rebirth of service cooperatives holds a special place among these. Before the Spanish Civil War, cooperativism had a firm connection with labour and civil movements in Catalonia. We are comrades of the historic grassroots leftist movements of the period which aimed to transform the inequitable socio-economic system and heirs to this tradition of cooperatives. After the first parliamentary elections that took place following the demise of the dictatorship regime in 1979, all projects that were kept under the rug for forty years began coming to life. Moreover, this awakening was not based solely on a sense of joy originating from the country disposing itself of dictatorship conditions. It also wanted to abolish the limitations imposed by the representative, liberal democratic system that was being newly experienced. In the end, this “democracy” established a system which merely confirmed monarchy. Thus, its legitimacy was being discussed rigorously among the leftist circles.

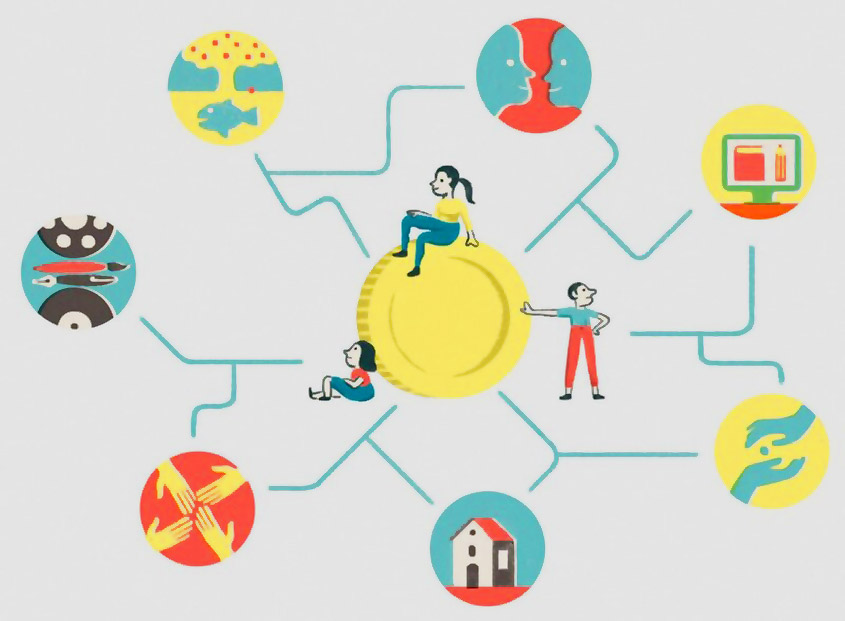

Insurance is a financial product and financial services should favor social benefit. For this very reason, it is crucial to build and reinforce the bridge between the two. To ensure that individuals and organizations that prefer ethical finance services also use ethical insurance services is one of the core purposes of Arç Cooperative.

In this environment, a group of people who came from different political structures but bonded over common needs and desires for action asked themselves the following question: What do we know to do? Since we are employed in the insurance sector, why don’t we do our work with a different structure and organizational form? The tradition of cooperatives was the most viable option they had. People were ready from the first day to be a part of a political and economic alternative rather than to struggle within capital markets like a regular insurance firm or agency. As a result, a group that shared common values and principles and aspired to change rather than accept the given, established Arç services cooperative.

According to Arç, one of the most important vehicles of social transformation and political participation is cooperativism. We use this vehicle to offer insurance services to the individuals and organizations with whom we share common principles and values and to strengthen the social market. We fulfill the insurance needs of organizations that operate within the realm of social and cooperative economy (SCE). Throughout thirty-five years, we’ve asked ourselves questions about who we are, what our activities are and approached ourselves critically. We question not only the principles we started with but also the way we expanded and developed. One of our most important achievements has been placing ethical insurance within the scope of ethical finance. This is because insurance is a financial product and financial services should favor social benefit. For this very reason, it is crucial to build and reinforce the bridge between the two. To ensure that individuals and organizations that prefer ethical finance services also use ethical insurance services is one of the core purposes of Arç Cooperative. We attach importance to principles of democracy, participation and self-governance in the name of cooperativism, we also care about the principle of collaboration among cooperatives. We are a part of the SCE network and ecosystem. We do our best to extend this network, provide services to other SCE projects and to strengthen the ecosystem by sharing our services as much as we can. For example, we shared sixty-thousand euros of our year-end profits with some of the collectives we work with. We have been doing this for the past decade.

Can you tell us how Arç functions and its partnership structure?

Arç ise a services cooperative which is collectively established by its workers. Individuals and organizations that benefit from our insurance services are not partners of the cooperative. Still, we perceive them as our friends rather than our clients. Our marketing policy does not focus around the service and product pricing unlike what is seen throughout the insurance sector. We aspire to a society that shares common principles, prioritizes social responsibility and possesses a critical understanding of consumption. Through ethical insurance services, we fulfill our own needs as well as refrain from causing an indirect harm to the society.

How do new partners join the cooperative?

Currently, Arç Cooperative has a crew of twenty individuals including seventeen working partners and three contractual employees. All workers who join the project have the same provisions, rights and obligations. Someone who joins our team cannot immediately become a partner of the cooperative. The first year serves as a period during which we get to know each other, experience working together and understand whether the new individual embraces the project or not. Then, we commence the partnership procedure. We decide on this by talking face to face. If the counterparty needs more than one year to make this decision, we extend the time window. What we care for in all circumstances is that all workers participate in the decision-making process. We are in total opposition to the instrumentalization of labour. For us, labour is not an ordinary tool but the very foundation of our project.

Our goal is not maximizing profits and our own economic, social and cultural needs rather than the needs of capital are at the center of the act of labour. Of course, while satisfying these needs, we never neglect our aim of social transformation.

We take the decisions in regular assembly meetings. Here, the principle of self-governance is implemented to the fullest. We all take responsibility because, this way, we believe that we can become the owners of our labour and apprehend the meaning of this labour. Everybody who works in Arç can transform their job by relying on their knowledge, skills and the relation they form with their fellow workers. At the heart of the production process lies the individual. Thus, there are no hierarchies embedded in the division of labour within the cooperative. Different tasks are carried out by different work groups within the production process, however, all these tasks display a continuity with each other. All executive, managerial and supervisory decisions are evaluated in the assemblies. Our goal is not maximizing profits and our own economic, social and cultural needs rather than the needs of capital are at the center of the act of labour. Of course, while satisfying these needs, we never neglect our aim of social transformation.

How do you associate with the individuals and organizations that you provide services to?

How do you associate with the individuals and organizations that you provide services to?

Fairness, equality and solidarity principles do not only determine our internal dynamics or the relationships within the SCE network. We also rely on these principles when we offer our insurance services. We do not have our own insurance policies. The individuals and organizations that benefit from our services own the products of the insurance companies we work with. Our cooperative is an intermediary; to put it in simple terms, it acts as an “insurance agency”. We would have loved to have our own insurance policies, but this is unfortunately not possible. This requires a very strong capital and an extensive social base or a potential “customer” group. At this point, it is imperative to remember the historical formula behind insurance. The fundamental principles of insurance are mutuality, transparency and equality. Mutuality is the utilization of a community’s resources for those who need them. This principle constitutes the backbone of insurance. The continuity of the society as a living organism hinges on the existence of social solidarity. This is the oldest and most comprehensible social mechanism known to us. People as social entities act with solidarity.

How is it possible that Arç offers the services and products of other companies and acts as an intermediary for social transformation at the same time?

We do this by deciding on which companies we work with. We offer the products and services of those firms with whom we share some of our principles and values. Obviously, the most ideal situation would be to work with firms that embrace the principles of ethical finance in their entirety. However, if this type of insurance company could exist within the borders of Spain, the founders would have been us in the first place.

Individuals and organizations that procure services from us pay about seven million euros of insurance premia annually. With this amount of economic activity, we created a total common value just shy of one million euros. We also transferred sixty thousand euros to organizations within the SCE ecosystem.

Since 2003-2005, we’ve begun putting more thought into this aspect of our work. We knew that we could not make any substantial gains in the name of social transformation by offering the products and services of capitalist establishments. Under this framework, we started to question the social, cultural and environmental commitments of the potential firms we could work with and evaluate whether they embrace the principles and values pertaining to ethical finance. Currently, we work with insurance firms that own the EthSI (Ethical and Solidarity Based Insurance) mark which provides a clear signal regarding a firm’s policies in the context of social sustainability and environmental justice. The EthSI mark was developed by the Ethical Finance Observatory which is a part of the social and cooperative economy network. It evaluates the insurance services and products offered by insurance firms and agencies with respect to social responsibility, service ethics and social solidarity criteria. Thanks to EthSI, we are aware of which firms are subject to monitoring and auditing. As a result, we continue our operations with organizations that embrace the values of social and cooperative economy such as Atlantis, Mútuaca and Northland rather than capitalist corporations such as Adeslas or Mafre. Although individuals and organizations that benefit from our services are not our partners, we offer our services to cooperatives that have a multitude of partners and collectivize consumption in the insurance field.

How many entities benefit from your services?

Currently, we manage the insurance programs of two thousand cooperatives and organizations. We also meet the insurance demands of 190 thousand individuals with around 4,500 policies. In 2018, we began working with seven thousand new entities of which about 5,500 are real people. This is an important detail because it shows that these individuals can get insured by us without being a member of an organization or a cooperative. Most of these people are not wealthy. Most of them need to insure their modest flats or vehicles. It is not true that ethical insurance services are more expensive. We offer service to these individuals under fair prices.

What is the amount of your capital and the volume of your transactions? What growth strategies are you pursuing?

Individuals and organizations that procure services from us pay about seven million euros of insurance premia annually. With this amount of economic activity, we created a total common value just shy of one million euros. This signals that we have maintained some sort of financial stability and it catalyzes our future development strategies. Some of our friends are cooperatives and collectives. We are trying to extend this ecosystem as of now. For example, we began working with AMPA (Student Parents Association) and we prepared affordable insurance policies that meet their needs. After we deduct the salaries and expenses from the common value created, we also transferred sixty thousand euros to organizations within the SCE ecosystem. We thought that since we are a cooperative and we make profits out of the services and products we offer then why shouldn’t we transfer some of these profits to the projects of other cooperatives? Arç has redistributed about 800 thousand euros to the SCE ecosystem until now. Aside from this, it has sponsored projects and organized trainings free of charge. The reasons why we could achieve these is our collective and solidarist relationships and the fact that we conduct a relatively profitable operation.

Are there salary/wage differences within the cooperative? If so, what are the reasons underlying these differences?

In principle, cooperative partners and workers do not have a fixed salary that they receive every month. We charge a fee for our labour by sharing the amount that is left to the cooperative as a result of our operations throughout the year. In other words, we pay for the labours of the members of the cooperative by distributing a portion of our profits. Of course, we provide for advances so that we can meet our daily necessities without waiting for the end of the year. The salaries of all of us are in essence advances.

Finance is not an end but a means for social utility. Thus, it should be collectively owned. Arç shares the same principle with other ethical finance organizations and pursues the collective ownership of financial vehicles.

There are three types of workers in Arç: Assistant, technical and managerial staff. The job definitions of these three categories are explained in the operation and action protocol. For example, assistants implement the standard procedures of the cooperative. Technical staff must carry out their responsibilities in an autonomous manner and continuously take initiative. Thus, they need to be educated in their fields and participate in continuing training in accordance with the regulations. The basic duty of the managerial staff is ensuring that both the economic and socio-politic aspects of the operation and our resources are in line with the cooperative’s principles. These three groups also have their own sub-groups. For example, the technical staff is divided into four groups among itself. These three groups and each sub-group do not receive the same salaries. We decide on how salaries will be distributed from the year-end profit in the general assembly in a collective manner. The maximum salary can at most be two and a half times of the minimum salary. There are twenty-five years old partners in Arç as well as sixty-five years old ones. Responsibilities range from answering the phones to managing the general coordination of the cooperative. These are some reasons why salaries may differ. On the other hand, when we make comparisons with the salary distributions in the standard finance sector, the group that receives the minimum “wages” in Arç still earn a larger income than the industry average. The group that receives the maximum “wages” earn an income which is much lower than the people who work at the same position in the finance sector.

Is it possible for the cooperative partners to change their position among these three groups? How do you decide on who does which task and for how long?

The distribution of our partner-workers’ labour force is done based on various evaluation criteria that are decided collectively and based on our members’ professional fields. These can also be found in our operation and action protocol. In our general assemblies, we use criteria based on the definition, difficulty and diversity of the job, the level of expertise and responsibility needed, the benefits and losses that the outcomes of the job will cause, the skills and abilities required by the position, experience, the necessity of using initiative and the frequency of work-related travels to decide on who will work in which category. Of course, any of us have the right to demand working in another field. Someone who is shouldering a lot of responsibility may say “I don’t want to carry this load anymore, I want an assignment among the assistant or technical staff”.

What are the activities that make Arç an ethical finance organization?

If the service you provide is insurance, this means that you work in the field of finance. Individuals and organizations make payments towards insurance policies to protect their physical integrities, wealths, jobs or commercial activities from potential risks. This also serves as a precaution to protect the cash they have. Whether you finance the cash or the risk, the field associated with this activity is finance. What makes us an ethical finance organization? Firstly, for us, finance is not an end but a means for social utility. Thus, it should be collectively owned. Arç shares the same principle with other ethical finance organizations and pursues the collective ownership of financial vehicles. Secondly, banks and insurance companies are institutional investors by nature. Traditional financial organizations use the savings of individiuals and institutions to invest in those areas where they can realize the maximum profits. They do not care about looking after social benefit. Traditional insurance companies also collect savings that they control for a long maturity just like banks and then, behave exactly the way banks would behave. If we are concerned about what banks do with our money, we should even be more concerned about the activities of insurance firms. This is because none of the investments of traditional insurance companies are subject to monitoring. Precisely against this, Arç Cooperative adopts the principles of the ethical finance ecosystem and works with ethical insurance firms as much as it can. We are an intermediary which scrutinizes the field as much as possible. On the other hand, the meaning of being an ethical finance organization is not just embracing certain principles for a certain period of time. What we try to do is watching out for the principles of reciprocity, transparency and equality and enhancing social relations that have their roots on these foundations while offering ethical insurance services. It is not acceptable for a portion of the society not to have access to these opportunities. Our concern is not just offering a certain number of insurance products or services but it is also to design alternative financial instruments and develop socio-political proposals to envision a new type of society.

The crisis of 2008 caused a disruption in the insurance sector. Millions of people lost their retirement savings as a result of the speculations carried out by pension funds. What are the problems associated with insurance in the era of financial capitalism?

Interestingly, I have not come across detailed and comprehensive research about the social damage that insurance activity has caused in Spain although insurance firms induce more harm than banks. It is possible to access statistical data about the investment activities of banks whose headquarters are in Spain. They are legally required to disclose this information to the public. However, insurance companies face no such obligation. It is very hard to reach this type of data, there are only some indicators. When we compare with the social risks that the investments of American insurance firms and funds cause, we can observe that insurance companies in Spain are gravitated towards more traditional investment areas. However, one can also spot dirty connections when closely looked. For example, in a report published by Centre Delàs (Observatory on Disarmament, Arms Trade, Armed Conflict and Culture of Peace), we can see that three of the twenty-five companies that make the highest amount of investments in the arms sector and arms trade are insurance firms or funds. La Caixa, one of Spain’s largest banks, owns an insurance firm named Adeslas which insures millions of people in the country. Under these conditions, it is unthinkable for Arç Cooperative to offer the insurance policies of firms such as Adeslas and Mafre to its friends. Of course, we do not have the network or facilities that we desire yet, thus, we cannot talk about the existence of a completely ethical finance organization. We aspire to do the best we can under the given conditions.

If we are concerned about what banks do with our money, we should even be more concerned about the activities of insurance firms. In a report published by Centre Delàs we can see that three of the twenty-five companies that make the highest amount of investments in the arms sector and arms trade are insurance firms or funds.

The world population is getting older. For example, in Japan, it is predicted that in 2050, there will be one retired person for every working person. This evidently is not a problem that can be solved by actuarial methods, but, what is your foresight?

We know how neoliberal financial capitalism tackles demographic change. It resorts to privatizing all social services and resources. All traditional insurance firms design their products and services based on this. Their ads say “When you get old, no one will be there to meet your needs.” Therefore, it is possible to encounter many different types of insurance products in the market such as pension funds, insurance policies that will satisfy your needs when you get destitute, health insurance, etc. They follow a marketing strategy that says “The government won’t be near you when you need it but we will”. This is an indication that the social contract has disintegrated. They have undermined the collective and social solidarity-based undertaking of the needs of those individuals who are not “productive” for some reason according to the criteria set by the capitalist economy. This is a horrible situation. The nullification of this contract that lies at the root of liberal democracy may also cause the democratic society to vanish in its entirety. Arç Cooperative did not offer services such as health or retirement insurance until a few years ago. This is because we believe that the right of people to costless healthcare and retirement benefits should be defended to the fullest. Until recently, we kept our distance with products that claimed to “replace” these rights. On the other hand, capitalist companies that provide these services are multiplying their capital accumulations. When we conduct a socio-political analysis, we can not deny that we can be accomplices to a crime by offering these services and legitimize the disappearance of public expenditures in these fields. However, individuals and organizations demand these services. We are facing a conflict in this matter and we still do not have a clear answer. In other situations, we are able to adopt a clear stand. For example, hunters need to have a liability insurance in Spain. We do not insure those who kill animals.

How are your relations with the Catalan government and the municipalities? What is your take on social and cooperative economy (SCE) institutions receiving public support?

We are fully committed to the principles of autonomy and advancing with our own resources. Our relation with public institutions have always been distanced and at an official level. We seldomly applied for support offered by the Catalan government to ease the addition of new partner-workers. This has changed since 2015 when a new municipal understanding was installed. Progressive coalitions that won local elections have developed new policies geared towards supporting the SCE network not just in Barcelona but also in other cities in Catalonia and Spain. They incentivize renewable energy. They do not just provide financial support but also give trainings, organize seminars and provide consultancy services to cooperatives established under municipalities. They give logistic support to SCE expos. This is a political decree that we stand for and appreciate. In the end, the contribution of public institutions to the dissolution of the social contract is clear. If the cafeteria of a school is managed by a company which is located far from the town that the school is in, then there is a big issue here. When municipalities stand up to this, support the SCE network, local economy and small businesses and prefer renewable energy in their buildings and ethical finance organizations, they cause a serious transformation. The local elections on May 26, 2019 were critical in this regard. It is essential that these kinds of policies take root and their continuity is ensured. Many cooperatives have been established in the last four years. Although many corporations have been liquidated since the 2008 global crisis, the number of cooperatives in Catalonia has not decreased. The reason for this is clear: Cooperatives build a sustainable system which serves social utility and the interests of labourers.

Translated by Yiğit Atılgan

Özgür Güneş Öztürk, Col·lectivaT – Cultural Translation, Research and Language Technologies Cooperative